Introduction to Angel Investing

An angel investor is an individual or syndicate of individuals who invest money in an early stage startup. An angel investor can be an individual professional like a doctor, a lawyer, an entrepreneur or a banker, or a firm or a company. Basically any person willing to invest and be a part of the startup’s journey is called an Angel Investor

Angels are enthusiastic and thrilled about budding entrepreneurs who are working on a product that might change the way a particular industry or sector operates. They have a strong belief in the founding team and the product/service that the startup is aiming to build.

Angels are risk-taking individuals and their investment is in the form of equity or debt in the start-up with the goal of profiting from its long-term growth. As the start-ups are in their early stages, some of them may fail and hence investment is done in small bytes and in diverse portfolio companies.

Angels are motivated and want to experience the thrill of being involved with an innovative company. They are passionate and driven individuals who are smart investors and believe in investing in high growth business opportunities of tomorrow. The role of Angels is not restricted to funding but they also play various roles in providing mentoring support for the startup, opening business growth opportunities for the startup and strategic guidance at various stages of the life cycle of the startup.

When their own money is invested by an Angel in a startup in exchange for equity or debt, it is termed as Angel Investing. Normally Angel Investment is for 3-5 years with the goal of profiting from the growth of the startup.

The benefits of Angel Investing are:

- Investment in the alternate new age asset class.

- Earning Probability of multibagger returns on investments.

- Building strategic business alliances with the startups.

- Mentoring the next generation of entrepreneurs.

- Creating impact on society and contributing to strengthening the economy by way of increasing wealth and job creation.

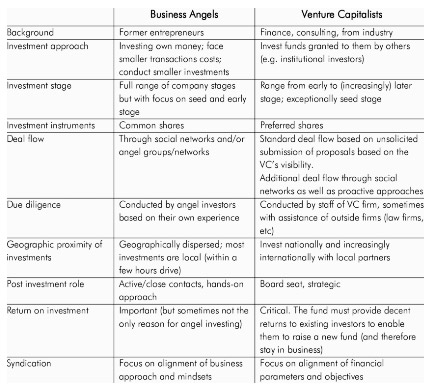

Angels invest in early stage ventures or startups where they see a potential for the company to grow, they complement the family and friends’ money. VC Funds invest in later stages of the company – beyond the stage of proof of concept, and at levels that are beyond the level of angels investing.

Venture Funds are targeted by their investors to invest in specific areas / sectors. Angel investors look at investing in diverse domains, and would consider investing in any area where some of their members have expertise.

After the investments are made, VC funds give direction and look for an exit through an IPO, Strategic sales, M&A. Angel investing continues – individuals invest as long as they wish. They, however, look at a 2 to 3 year exit and the most common exits are strategic buyouts / mergers & acquisitions.

The VC funding process is more complex as they are funds and have a statutory framework within which they work. Angel investing provides for a simpler process as angel investments are an alternative asset class for individuals and the angels invest directly in the investee companies.

Angels prefer companies with

- Novel business concepts & products and disrupting ideas.

- High growth, fast scalable and less capital intensive businesses.

- Experience and knowledgeable founding team.

- Market size, demand and repeat sales capacity of the product.

Develop a personal investment thesis.

Don’t just invest money, invest time to understand the startup and build relation with the community.

Diversify. Never put all eggs in one basket. Invest in multiple companies of varied sectors.

Connect with the founders and be part of their journey.

Think and take decisions based on longer timeframe horizons.

Successful start-ups move to the next rounds of funding called Series A, series B and beyond. A typical exit comes when a larger investor from these rounds buys your shares. An exit time frame may vary from 3-5 years.

At times, the start-ups business catches the attention of a large strategic investor; traditional corporate or other well-funded start-ups for its strategic value and an acquisition takes place, providing exit to early stage investors.

New avenues such as MSME listing on stock exchanges have come up, which over a period of time are likely to become a platform for liquidity.

Angels invest their own money and are more often than not entrepreneurs themselves. VC Funds have now adopted a model where they have people with domain expertise / thought leadership in a sector to advise them on deal flows and then nurture companies.

When Angels come together and invest, it helps the Angel community:

- In gaining access to better deal with the startups.

- It helps to make more sizable and meaningful investment and participate in larger funding rounds.

- It lowers the risk in investing as Angels can start with small capital and still be part of a successful syndication and create a portfolio.

- It increases investment diversification.

- It increases their ability to conduct better due diligence.

- It provides hassle free pre investment and post investment processes; as the angel platform takes care of all activities from screening, due diligence, negotiation on terms, legal paperwork for investment to post investment reporting and periodic sharing of updates and connecting to Venture Capital firms for next round.

- It gives more power to control the success of the startups.

- The collective synergy of the angels helps the startups in building strategic alliances and providing guidance at varied cycles of their business.

- The networking in the community helps in gaining experience and alliances between the members of the group

The size of the market for the product and if there is a measurable set of customers for the product.

Check for the competition for the product/ service and check if the product is capable of overtaking the existing competitor in the market.

The experience and knowledge of the founding team with respect to the product.

To check if the idea is disruptive in nature and will it solve an existing problem. Is the problem big enough and requires a solution. Will there be repeat purchases?

To check if the customers will pay for getting the solution.

Is there a planned roadmap for the next 6-12 months? If yes, how effective is it?

Licenses for production, distribution and necessary compliances are adhered to. Scope of all Liability and litigation is avoided.

Business Moat.

Proprietary Technology (if any), Valuable intellectual property – IP protected by patents, trade secrets, or the barrier of time to replicate

Potential exit opportunities